Health insurance payroll deduction calculator

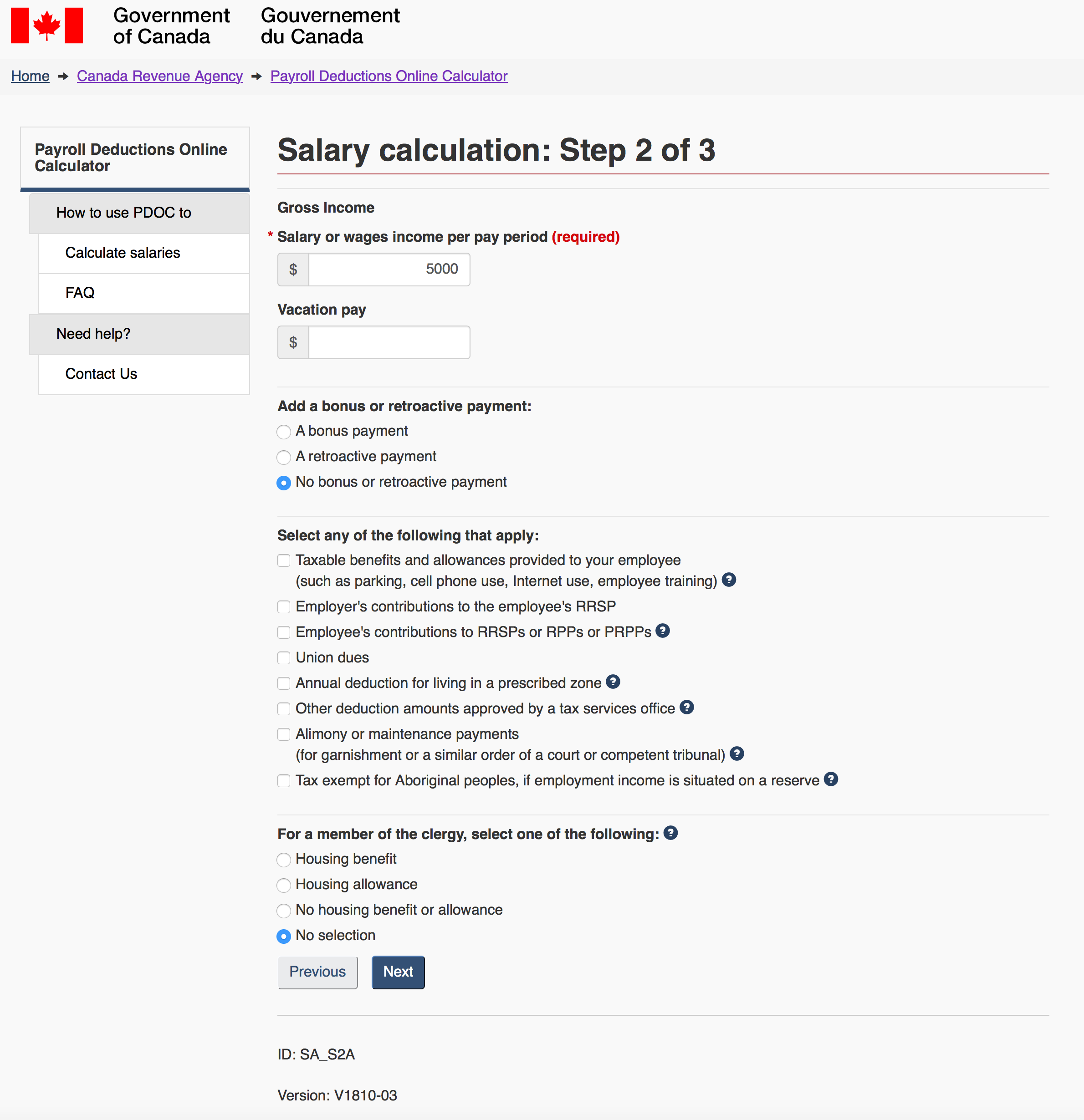

Payroll withholdings for health insurance are the amounts deducted from employees pay for their portion of the cost for the companys health insurance plan. Payroll Deductions Comparison Calculator.

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Determine the employees medical premium.

. You can enter your current payroll information. The insurance company will bill the employer for the full 300 per month and then the employer will withhold 150 per month from the employees paycheck. 2022 Federal income tax withholding calculation.

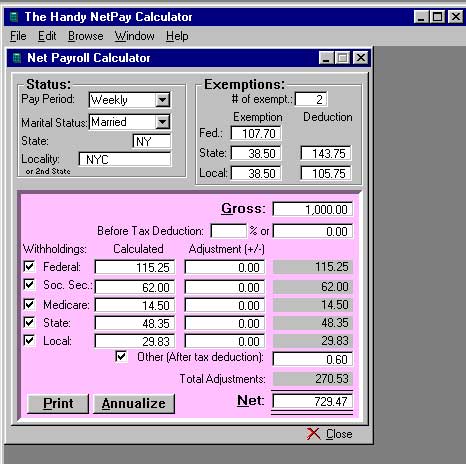

This Payroll Deductions Calculator will help you to determine the impact that changing your payroll deductions can have on your financial situation. Calculating payroll deductions is the process of converting gross pay to net pay. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Your taxes are estimated at 11139. 2000 300 1700 After deducting the health insurance premiums the employees pay. 1547 would also be your average tax rate.

Taxpayers can choose either itemized deductions. All Services Backed by Tax Guarantee. Typically this is your gross earnings minus employer paid health insurance and any Flexible Spending Account FSA contributions.

You can enter your current payroll. 100 of benefits deductions in the third paycheck will be catch-ups. This is 338328 of employee paid health insurance premium per year.

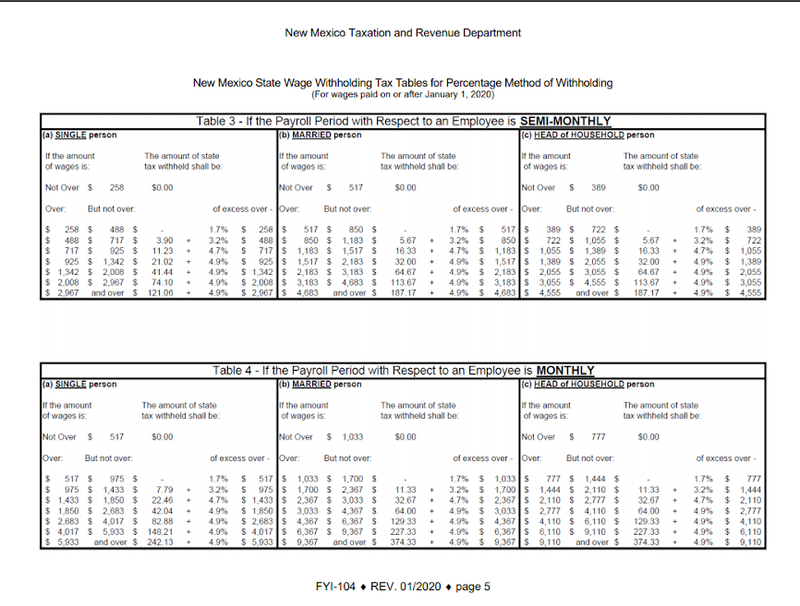

Subtract 12900 for Married otherwise. Download or Email Form 2159 More Fillable Forms Register and Subscribe Now. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Employees total taxable pay when payrolling is 243333 2000 43333. Small Business Health Insurance Is Complicated eHealth Is Here to Help. Adjust gross pay by withholding pre-tax contributions to health insurance 401 k retirement.

Free Unbiased Reviews Top Picks. As a payroll representative you are to calculate medical deductions according to company policy and federal and state requirements. Say Ricky earns 1000 per pay period in gross wages earnings before paycheck deductions.

Ad Web-based PDF Form Filler. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. All Services Backed by Tax Guarantee.

So while you do. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Your income puts you in the 25 tax bracket.

2022 Federal income tax withholding calculation. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Ad Explore Plans From 1300 Small Business Health Insurance Plans From 70 Carriers.

So before withholding any taxes deduct 300 for the pre-tax health insurance. He contributes 30 per pay period for health insurance costs. Use this calculator to help you determine the impact of changing your payroll deductions.

401 k contributions as a percentage of salary are deducted from all paychecks. Example of Payroll Withholdings. Subtract 12900 for Married otherwise.

2022 Federal income tax withholding calculation. Edit Sign and Save Payroll Deduction Agrmt Form. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Compare This Years Top 5 Free Payroll Software. In 2022 year-to-date earnings is not required or used. 338328 of health insurance premium over 26 pay periods 338328 divided by 26 13013 You should.

Typically this is your gross earnings minus employer paid health insurance and any Flexible Spending Account FSA contributions. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. This is 1547 of your total income of 72000.

The taxable amount of the car benefit at each payday is 43333 5200 12 43333. In 2022 year-to-date earnings is not required or used. Subtract 12900 for Married otherwise.

Payroll Online Deductions Calculator Discount 54 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes In 5 Steps

Federal Withholding Calculator Online 59 Off Www Ingeniovirtual Com

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Tax Payroll Calculator Shop 59 Off Www Wtashows Com

Payroll Calculator Template Free Payroll Template Payroll Templates

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Time Management Worksheet

Real Estate Lead Tracking Spreadsheet

Payroll Tax Calculator For Employers Gusto

Paycheck Calculator Take Home Pay Calculator

Payroll Online Deductions Calculator Discount 54 Off Www Wtashows Com

Self Employed Health Insurance Deduction Healthinsurance Org

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates Business

Payroll Online Deductions Calculator Discount 54 Off Www Wtashows Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay